tenancy agreement malaysia stamp duty

Learn the specific estate planning documents you need to protect yourself and your loved ones. 500- whichever is lower.

Create Cv Dynamic Descriptor Ai Computer Vision Uipath Community Forum

Civil Law Act 1956 is the legislation which would cover payment disputes.

. 1 Legal Calculator App in Malaysia. So if you need to be on a safer side you can make the agreement on a Stamp paper of the appropriate value as prescribed by the government. If the rental provider finds new tenant within a set period defined in the agreement then this amount is reduced.

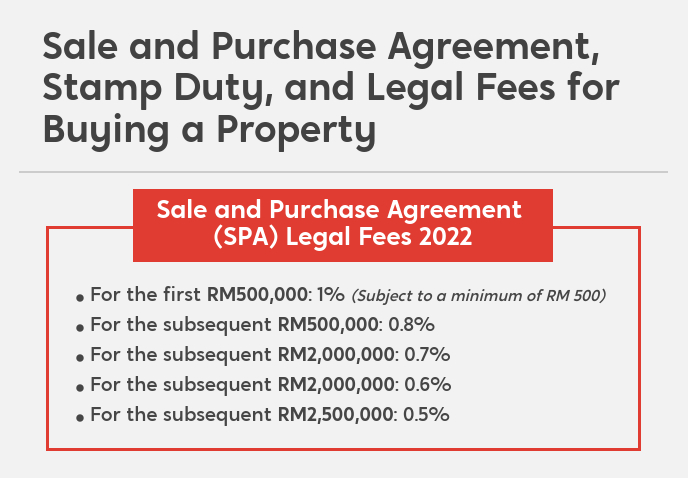

The stamp duty for the SPA is only RM10 per copy while the stamp duty for MOT and DOA is calculated according to a fee structure of 1 to 4. Admin Fee Amount RM1000. Most rent agreements are signed for 11 months so that they can avoid stamp duty and other charges.

The tenant has entered into a Higher Tier Countryside Stewardship agreement on land within his tenancy of Lower Fuge Farm lot 2. Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption. Plan for your future today.

As the tenancy agreement was made through a property application on your phone which would have generated andor stored an electronic record of the transaction an electronic document chargeable with stamp duty would be created. Tenants in Common There are several ways two or more people can own property together including tenancy in common and joint tenancy. Meanwhile if you wish to know more about the Real Property Gain Tax we recommend users to contact us or download EasyLaw mobile - The No.

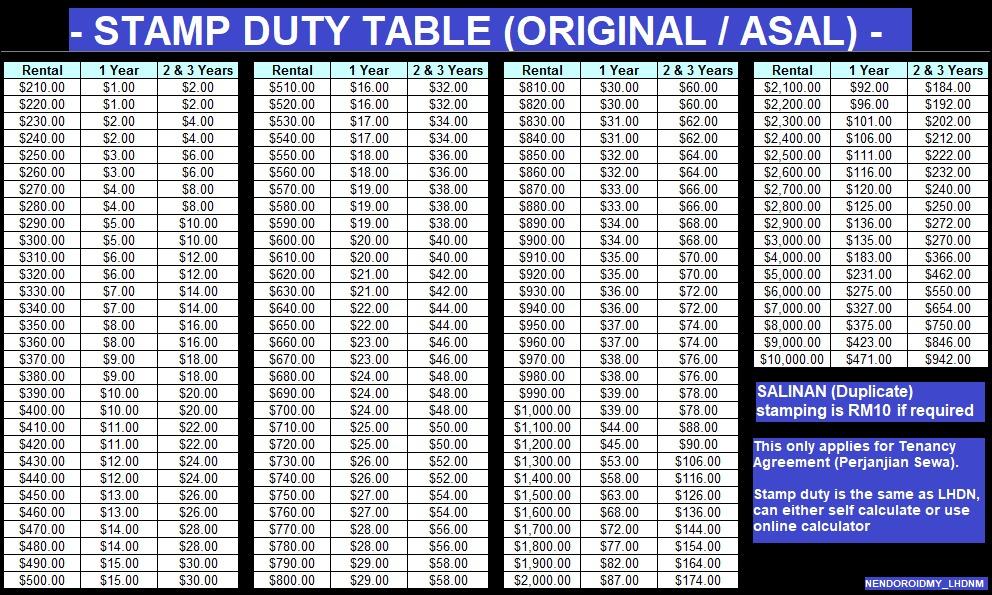

The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord. Prepare a list of requirements for your ideal room. The stamp duty for a tenancy agreement in Malaysia is calculated as the following.

Accordingly use the filters on PropertyGuru and narrow down the choices. As of new laws brought into effect from 2019 tenancy agreements in the ACT may include a lease break fee which is required to be paid by the tenant to the landlord if they wish to end the agreement early. As such you would need to pay stamp duty on the lease of the property.

Stamp duty is payable under Section 3 of the Indian Stamp Act 1899. MOTIVE TEST -- Test often found in tax rules which are designed to prevent tax avoidance. A full stamp duty exemption is given on.

Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. For example the rules may provide that certain consequences will follow if the sole main or principal purpose of certain transaction is the reduction of. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement.

1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. I joined the German Police Force in 2001 and spent the first years of duty in the riot police and carrying out patrol service. For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is RM2 for every RM250 of the annual rent in excess of RM2400.

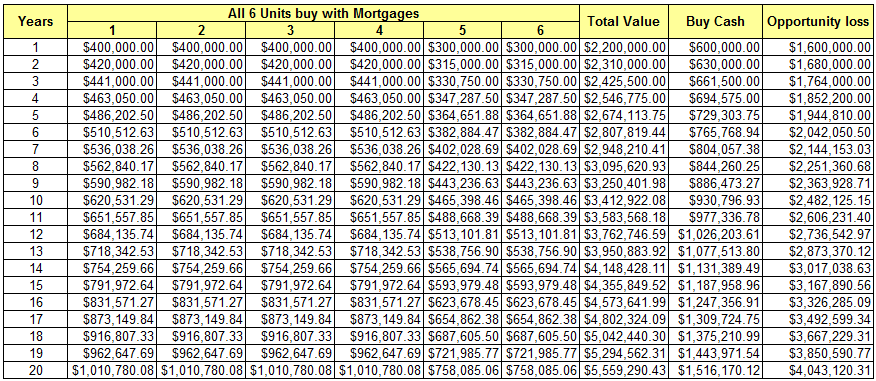

The stamp duty for a Sale and Purchase Agreement is often mistaken for the stamp duty for Instrument of Transfer. Contracts Act 1950 is the legislation which would cover conflicts on the tenancy agreement. Capital growth is where an asset increases in value over time.

Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental. Joint Tenancy vs. Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250.

How to Get a Copy of a Will If you want to obtain a copy of a will for legal reasons or simply out of curiosity you may be able to access it simply by requesting it. For example if a property is purchased for 500000 and then sold five years later for 650000 this 150000. Distress Act 1951 is the legislation covering matters of eviction.

According to the Registration Act 1908 the registration of a lease agreement is mandatory if. Ii After completion of Tempoh kontrak year tenancy period from the date hereof if the Tenant desires to terminate the Tenancy Agreement before the expiration of the term hereby created the Tenant shall be required to give a three 3 month written notice of such sooner determination. The stamp duty is free if the annual rental is below RM2400.

This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price. The agreement should be printed on a Stamp paper of minimum value of Rs100 or 200-. Submit a Letter of Intent LOI to the landlord Step 4.

Plan for your future today. Iii However prior to the completion of a year Tempoh kontrak year period from the date hereof-. Sign the Tenancy Agreement Step 5.

Most of the farmland is registered with the Rural Payments Agency however no entitlements will be included in the sale. Residential properties transferred into trusts for housing developers will continue to be subject to the. Benefits of negative gearing The market value should increase over time.

Legal Fee - Sale Purchase Agreement Loan Agreement. There are no employees. In 2008 I was seconded to one of the first newly founded Cybercrime Units in Germany where I was part of the team building the unit from scratchFrom 2013 to 2016 I worked in an IT-Development Department as a software.

Shortlist and negotiate the monthly rent Step 3. Stamp duty on rental agreements. Also read all about income tax provisions for TDS on rent.

Or you can use Tenancy Agreement Stamp Duty Calculator Malaysia to Calculate. Specific Relief Act 1950 prohibits a landlord evicting the tenant or making the property inaccessible to tenants without a court order. Stamp duty is the governments charge levied on different property transactions.

Stamp duty is 1 of the total rent plus deposit paid annually or Rs. Pay the Rental Stamp Duty and move in. MORTGAGE TAX -- Tax on mortgages usually in the form of a stamp duty levied on the mortgage document.

A trust that is created by a person during his or her lifetime with effect from 9 May 2022This will be known as ABSD Trust. Learn the specific estate planning documents you need to protect yourself and your loved ones. How Much Is Stamp Duty For Tenancy Agreement In 20202021.

Get the right guidance with an attorney by your side. On 8 May 2022 the Government announced that ABSD of 35 will apply on any transfer of residential property into a living trust ie. Our network attorneys have an average customer rating of 48 out of 5 stars.

And if the Tenancy Agreement has been signed for more than 3 years the. Jul 27 2022 3 min read. Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400.

Tenancy Agreement Stamp Duty Calculator Malaysia.

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Amended Tenancy Agreement 2013

Drafting And Stamping Tenancy Agreement

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Tenancy Agreements In Malaysia You Should Know Home

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Solved One Of The Theories Regarding Initial Public Offering Chegg Com

Opportunity Loss For Cash Buyer Property Malaysia

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Rumah Sewa Malaysia Stamp Duty For Tenancy Agreement Facebook

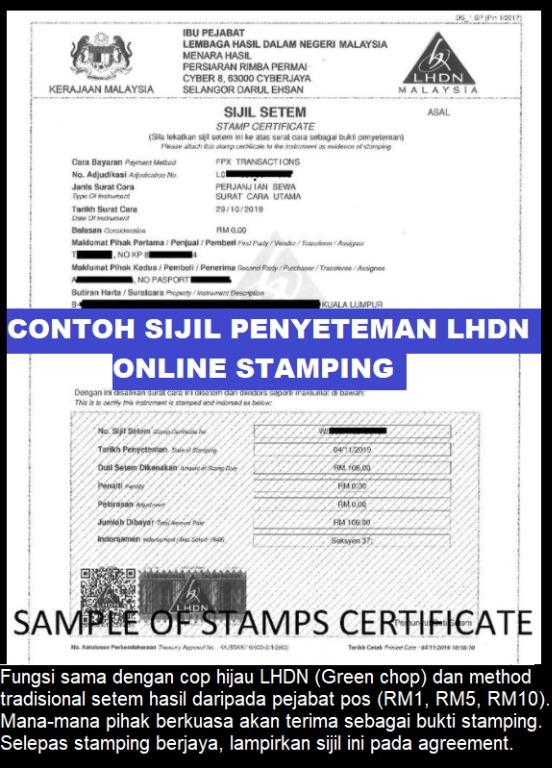

Lhdn Tenancy Agreement Stamping Service Lhdn Online Stamping Penyeteman Perjanjian Sewa Perjanjian Sekuriti Perjanjian Am 合同 合约 印花税 Verified Jobs Full Time Customer Service On Carousell

Comments

Post a Comment